Many people delay investing because they believe it requires large sums of money or perfect timing. Systematic Investment Plans (SIPs) challenge this belief by allowing investors to start small and invest consistently.

This article explains how SIPs work and why they are widely considered a beginner-friendly approach to mutual fund investing.

What Is a SIP?

A SIP allows investors to invest a fixed amount at regular intervals—monthly, quarterly, or otherwise—into a mutual fund scheme. This approach encourages disciplined investing without the need to monitor market movements constantly.

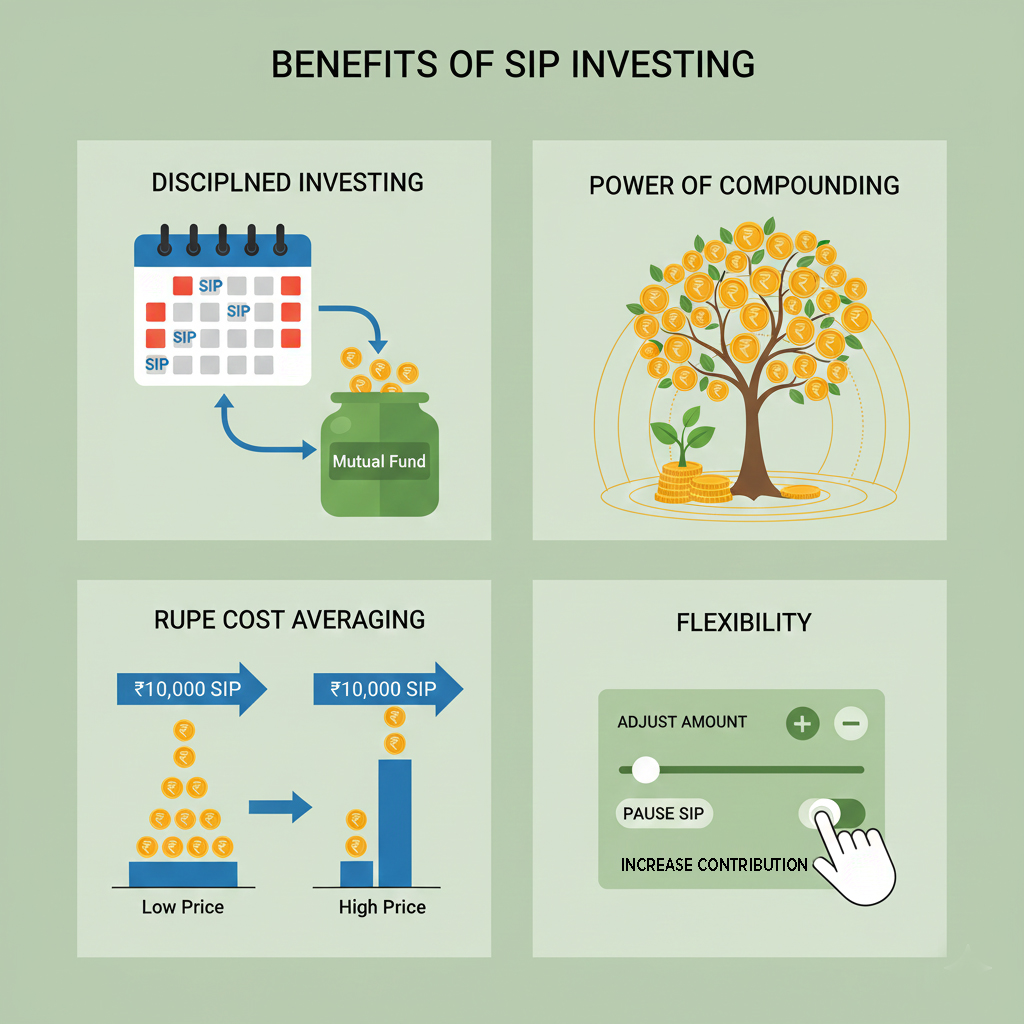

Benefits of SIP Investing

Disciplined Investing

SIPs help build a habit of investing regularly, regardless of market conditions.

Power of Compounding

Small, consistent investments grow significantly over time due to compounding.

Rupee Cost Averaging

By investing regularly, investors buy more units when prices are low and fewer units when prices are high, reducing the impact of market volatility.

Flexibility

SIPs can be started with small amounts and increased gradually as income grows.

Is SIP Risk-Free?

No investment is completely risk-free. SIPs invest in mutual funds, which are subject to market risks. However, long-term SIP investing helps reduce timing risk and smoothens market fluctuations.

Who Should Consider SIPs?

SIPs are suitable for:

- First-time investors

- Salaried professionals

- Self-employed individuals

- NRIs investing in Indian mutual funds

- Anyone planning long-term financial goals

Conclusion

SIPs offer a simple, disciplined, and flexible way to begin investing in mutual funds. They remove the pressure of timing the market and encourage long-term thinking—making them ideal for investors at any stage of life.

Leave a Reply